LIC’s Dhan Rekha (UIN: 512N343V01)

It is a Non-Linked, Non-Participating, Individual, Savings, Life Insurance Plan.

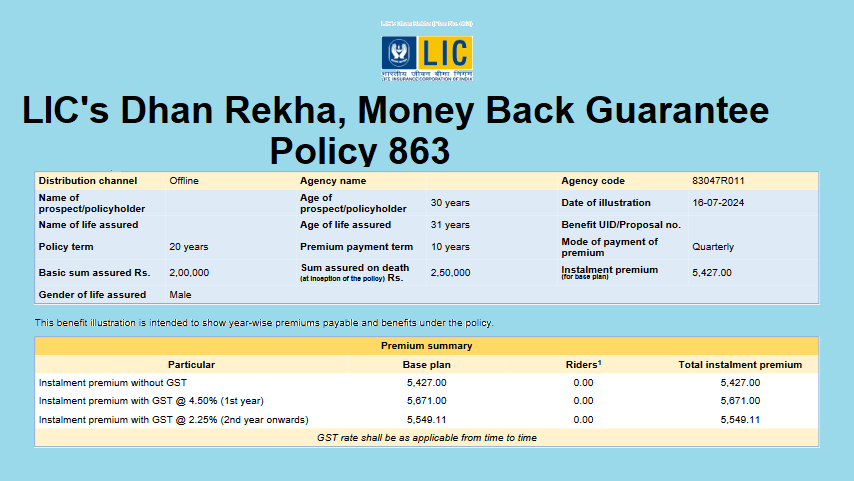

LIC Dhan Rekha Money Back Guarantee Policy is an insurance plan that combines savings and protection. It ensures financial support for your family if you pass away during the policy term. If you survive the policy term, you receive periodic payments at certain intervals and a lump sum at maturity. Additionally, you can also take a loan from this plan if you need immediate cash, providing flexibility in managing your finances.

Table of Contents

LIC Dhan Rekha Money Back Guarantee Policy -Eligibility Conditions :

| Basic Sum Assured | Min = 2lakh |

| Max = No limits (but multiples of 25,000) | |

| Policy Term | 20 Years 30 Years 40 Years |

| Premium Paying Term | 10 Years 15 Years 20 Years |

| Minimum Age at Entry | 8 years (Completed) for Policy Term 20 years 3 years (Completed) for Policy Term 30 years 90 days (Completed) for Policy Term 40 years |

| Maximum Age at Entry | Single Premium 60 years (Age Nearer Birthday) for Policy Term 20 years 50 years (Age Nearer Birthday) for Policy Term 30 years 40 years (Age Nearer Birthday) for Policy Term 40 years |

| Limited Premium 55 years (Age Nearer Birthday) for Policy Term 20 years 45 years (Age Nearer Birthday) for Policy Term 30 years 35 years (Age Nearer Birthday) for Policy Term 40 years (65 years (Age Nearer Birthday) minus policy term in case of policies procured through POSP-LI/CPSC-SPV ) |

| Mode of Purches | Offline/Online |

| This plan can be purchased Offline through agent /other intermediaries as well as Online directly through website www.licindia.in. | |

| Mode of Installment | Monthly, Quarterly, Yearly |

| Death Benefit | 1.Single premium payment (125% of Basic Sum Assured.) 2.Limited premium payment (25% of Basic Sum Assured or 7 times of annualized premium. ) |

| Survival Benefit | i. 20Year Policy Term ( Will get benefits of 10% of the Basic Sum Assured at the end of each of 10 th and 15th policy year. ) ii. 30 Year Policy Term ( Will get benefits of 15% of the Basic Sum Assured at the end of each of 15 th, 20th and 25th policy year ) iii. 40 Year Policy Term ( Will get benefits of 20% of the Basic Sum Assured at the end of each of 20 th , 25th ,30th and 35th policy year ) |

| Maturity Benefit | Sum Assured on Maturity” along with accrued Guaranteed Additions |

| Guaranteed Additions | Policy Duration (in years) . i From 6th to 20th (Rs 50 per rs1000 Basic Sum Assured ) ii.From 21st to 30th ( Rs 55 per 1000 BSA ) iii. From 31st to 40th ( Rs60 per 1000 BSA ) |

1.Benefits payable :-

A. Death Benefit:

For Adults (Age 8 years and above at entry):

- If the policyholder passes away after the risk coverage starts, the Death Benefit paid to their family includes the “Sum Assured on Death” plus any guaranteed additions that have accumulated.

- For policies with a single premium payment, the “Sum Assured on Death” is set at 125% of the Basic Sum Assured.

- For policies with limited premium payments, the “Sum Assured on Death” is either 125% of the Basic Sum Assured or 7 times the annualized premium, whichever is higher.

- The Death Benefit under limited premium payment policies will not be less than 105% of the total premiums paid (excluding any extra premiums, rider premiums, and taxes) up to the date of death.

For Minors (Below 8 years at entry):

- If a child insured under the policy is below 8 years old and unfortunately passes away before the risk coverage starts, the Death Benefit paid is a refund of the premiums paid so far (excluding taxes, any additional underwriting charges, and rider premiums).

These terms ensure that the policy provides financial support to the family in case of the policyholder’s untimely death, depending on whether the policy has entered into the risk coverage phase or not.

B. Survival Benefit :-

- Policy Term of 20 years:

- If the policyholder survives to the 10th and 15th policy years, and the policy is active (in-force), they will receive 10% of the Basic Sum Assured at the end of each of these years.

- Policy Term of 30 years:

- If the policyholder survives to the 15th, 20th, and 25th policy years, and the policy is active (in-force), they will receive 15% of the Basic Sum Assured at the end of each of these years.

- Policy Term of 40 years:

- If the policyholder survives to the 20th, 25th, 30th, and 35th policy years, and the policy is active (in-force), they will receive 20% of the Basic Sum Assured at the end of each of these years.

These Survival Benefits provide periodic payouts to the policyholder during the policy term if they continue to be insured under the policy and have reached the specified durations. It offers a way to receive portions of the Basic Sum Assured at specified intervals while the policy is active.

C. Maturity Benefit :

If you live until the policy’s maturity date and the policy is still active, you will receive the “Sum Assured on Maturity” along with any guaranteed bonuses that have accumulated. The “Sum Assured on Maturity” is the same amount as the Basic Sum Assured that was originally promised when you took out the policy. So, upon reaching maturity, you’ll get the guaranteed sum assured plus any additional guaranteed benefits earned over time.

D. Guaranteed Additions

- Accrual Conditions: Guaranteed Additions will be added to the policy if it remains active and premiums are paid on time. These additions start accruing from the 6th policy year until the end of the policy term.

- Rate of Guaranteed Additions: The rate of Guaranteed Additions increases progressively with the duration of the policy:

- From the 6th to the 20th policy year: ₹50 per ₹1000 of Basic Sum Assured.

- From the 21st to the 30th policy year: ₹55 per ₹1000 of Basic Sum Assured.

- From the 31st to the 40th policy year: ₹60 per ₹1000 of Basic Sum Assured.

- Death Benefit: If the policyholder passes away while the policy is active, the Guaranteed Addition for that policy year will be paid in full.

- Impact of Premium Non-payment:

- For limited premium payment policies, if premiums are not paid on time, Guaranteed Additions will stop accruing.

- Paid-up or Surrendered Policies: If the policy becomes paid-up or is surrendered, the Guaranteed Addition for the policy year in which the last premium was paid will be added on a proportional basis according to the premium received for that year.

These conditions ensure that Guaranteed Additions accumulate over the years, provided the policy remains active with timely premium payments, and are adjusted accordingly in case of changes in the policy status or conditions.

2. Eligibility Conditions and Other Restrictions

a) Minimum Basic Sum Assured: ₹2,00,000

b) Maximum Basic Sum Assured: No limit (in multiples of ₹25,000)

c) Policy Term Options: 20 years, 30 years, and 40 years (20 years for policies through POSP-LI/CPSC-SPV)

d) Premium Paying Term:

- Single Premium: Not applicable

- Limited Premium:

- 10 years for Policy Term 20 years

- 15 years for Policy Term 30 years

- 20 years for Policy Term 40 years

e) Minimum Age at Entry:

- 8 years (completed) for Policy Term 20 years

- 3 years (completed) for Policy Term 30 years

- 90 days (completed) for Policy Term 40 years

f) Maximum Age at Entry:

- Single Premium:

- 60 years (age nearer birthday) for Policy Term 20 years

- 50 years (age nearer birthday) for Policy Term 30 years

- 40 years (age nearer birthday) for Policy Term 40 years

- Limited Premium:

- 55 years (age nearer birthday) for Policy Term 20 years

- 45 years (age nearer birthday) for Policy Term 30 years

- 35 years (age nearer birthday) for Policy Term 40 years

- For policies through POSP-LI/CPSC-SPV: 65 years (age nearer birthday) minus policy term

g) Minimum Age at Maturity:

- 28 years (completed) for Policy Term 20 years

- 33 years (completed) for Policy Term 30 years

- 40 years (completed) for Policy Term 40 years

h) Maximum Age at Maturity:

- Single Premium: 80 years (age nearer birthday)

- Limited Premium:

- 75 years (age nearer birthday)

- For policies through POSP-LI/CPSC-SPV: 65 years (age nearer birthday) minus policy term

These criteria outline the age limits for entry and maturity, policy term options, premium payment terms, and the range of Basic Sum Assured amounts available for the Dhan Rekha policy.

What is the Process to Purchase the Dhan Rekha Policy

- Online: Visit LIC’s official website and follow the instructions to purchase the policy digitally.

- Offline through Intermediaries/ Agents: Contact LIC agents or intermediaries who can assist you in purchasing the policy offline.

- Common Public Service Centres (CSCs): Visit CSCs where you can also purchase the policy through authorized channels.