Tata AIG MediCare – Medical emergencies can happen unexpectedly. No matter how healthy you are, you might face one in your lifetime. Besides the physical impact, these emergencies can cause financial and mental stress.

With Tata AIG MediCare health insurance, you don’t need to worry about high medical expenses. This policy covers not only hospital stays but also treatments before and after. If you test positive for COVID-19, our policy will cover the costs of your treatment as well.

Starting Premium ₹350/month

PED Coverage Covered after 2 years

Table of Contents

Advantages Of Tata AIG Health Insurance

Using cashless claims with Tata AIG’s health insurance is straightforward. Tata AIG partner with over 8,000 hospitals across India, ensuring you have easy access to medical care wherever you are. If you can’t reach one of our network hospitals, you can still get treated at any reputable healthcare facility and claim reimbursement later.

Tata AIG MediCare – Save On Taxes

When you buy medical insurance, the premium you pay can reduce your taxable income under Section 80D of the Income Tax Act, 1961. If you’re under 60 years old, you can claim up to INR 25,000 as a deduction. If you’ve bought insurance for a parent aged 60 or above, you can claim an extra deduction of up to INR 50,000. Please be aware that tax benefits may change as per Income Tax laws.

Tata AIG MediCare – Paperless Policies

In today’s fast-paced digital world, Tata AIG know the importance of having your documents handy. Once we issue your health insurance policy, Tata AIG’ll send you a digital copy. You can easily show this digital copy to the TPA at the hospital to start processing your health insurance claims. No need to carry around a paper or card to prove you have our health insurance!

A TATA Promise

TATA health insurance policies come with the 150-year legacy and trust of TATA. As an insurance company, they’ve been keeping our promise of looking after you, your health and your finances for over 20 years! When TATA commit to something, we stick to it.

Tata AIG MediCare – Safe And Secure

Your privacy and data security are important to us. Our website ensures a secure environment for entering your details and making health insurance premium payments. We guarantee 100% security for your personal and payment information at all times. Explore our health insurance premium calculator to determine your insurance premium.

High Claim Settlement Ratio

Before you purchase or renew your health insurance, you probably want to know how likely your claim will be approved if it’s valid. We’re proud to say that in the fiscal year 2023-24, we approved 96.70% of all health insurance claims we received.

Round the Clock Assistance

Our mission is to understand and meet all your needs. Your priorities come first, and we strive to surpass your expectations every time. With round-the-clock customer support, we’re here for you even if you have an emergency late at night.

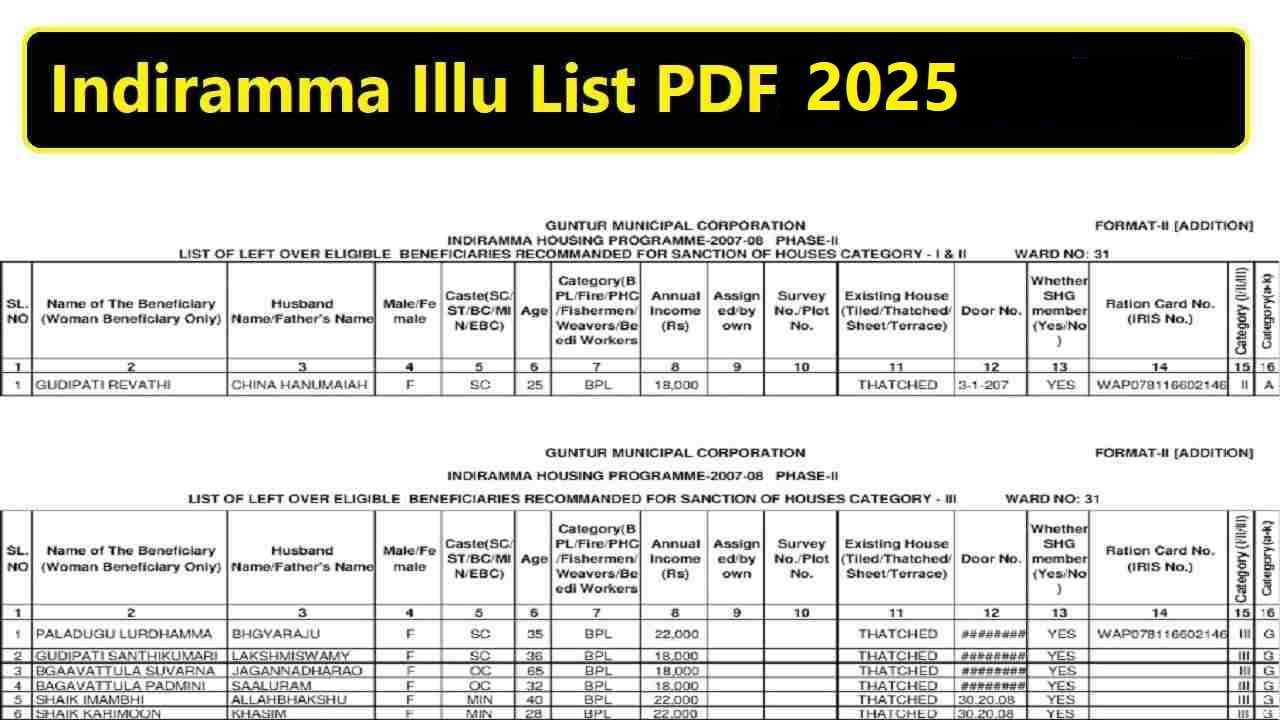

Get QuoteIndiramma Illu List PDF Telangana Status Check 2025 Search District Wise

Indiramma Illu List PDF:- The Telangana state government has brought delightful news for its citizens by officially releasing the Indiramma Housing Scheme List 2025. All residents who applied for the scheme can now conveniently check the beneficiary list online through the official website. This digital initiative ensures that citizens can access their details without the…

TS Rythu Bharosa 2nd Phase Status Check Online, List PDF & Payment at rythubharosa.telangana.gov.in

TS Rythu Bharosa 2nd Phase Status Check Online:- The Telangana Rythu Bharosa Scheme is a flagship initiative introduced by the Congress government in Telangana to provide crucial financial support to farmers. Launched on January 26, 2025, by Chief Minister Revanth Reddy, this scheme aims to empower farmers by offering ₹12,000 per acre in annual investment…

Indiramma Illu Application Status Search By Aadhaar Number, Download Form & List PDF 2025

Indiramma Illu Application Status 2025:- The Telangana government has taken a significant step toward providing secure housing for its citizens through the Indiramma Illu Scheme 2025. This initiative aims to uplift economically weaker sections (EWS) and below-poverty-line (BPL) families by offering financial aid for constructing durable houses. Indiramma Illu Application Status 2025 Check Applicants can…